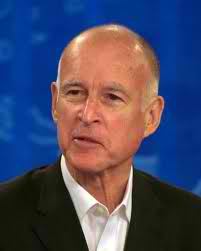

Days before Gov. Jerry Brown releases his revised budget proposal for the coming year, Republicans in the state Assembly have offered their own outline they say would balance the budget without renewing temporary taxes that have expired or about to do so.

The plan would protect Kindergarten through community college education, giving the schools the same amount Brown has already proposed, and avoid any more cuts in the state’s four-year public universities.

With those assumptions in mind, the outline seeks to erase what would be about a $14 billion gap between current spending trends and revenues projected in January.

The centerpiece of the plan is an assumption that revenues will actually come in $5 billion higher than projected. Half of that amount — $2.5 billion — is already in the state’s coffers, thanks to a healthy spring of tax collections buoyed by a recovering economy. The Republicans assume another $2.5 billion in excess of Brown’s January projection will come to the state during the 12 months starting July 1.

Another big revenue bump: the Republicans want to shift about $2.4 billion to the state’s general fund from three special funds created by voters when they adopted cigarette taxes to fund anti-tobacco programs and children’s services and a personal income tax surcharge on million-dollar earners to finance mental health programs. The Republicans say they money they want to shift is all held in reserves for those programs, although advocates for the programs say otherwise.

The GOP lawmakers are also counting on the Legislature adopting at least $2.4 billion in changes Brown has recommended, including the elimination of local redevelopment, $1.3 billion in cuts to state programs and a $100 million fee on managed care health plans.

They want to take another $1.1 billion out of payroll costs, which they say represents a 5 percent cut, and save roughly another $1 billion with efficiencies in Medi-Cal and medical care in the state prisons.

The plan says the state could save another $1.3 billion by using electronic recording in the courts rather than human court reporters, by contracting out transportation and dining services at facilities for mentally ill people and developmentally disabled people, and by implementing an across-the-board 10 percent cut in state operating expenses and equipment costs.

It’s not clear how the Republican plan would compare to Brown’s beyond its first year. One thing is clear: the $2.4 billion borrowed from the reserves in ballot measure funds would have to be repaid, and the same amount could not be borrowed again next year. So that could leave a big hole in the budget. On the other hand, Republicans say their assumption that state revenues will grow by $2.5 billion next year beyond the governor’s projections is conservative. If more revenue comes in, it could make up for other holes in their plan.

Brown’s most recent proposal calls for $11 billion in new revenue from the expiring taxes. He wants to renew those higher taxes for another five years.