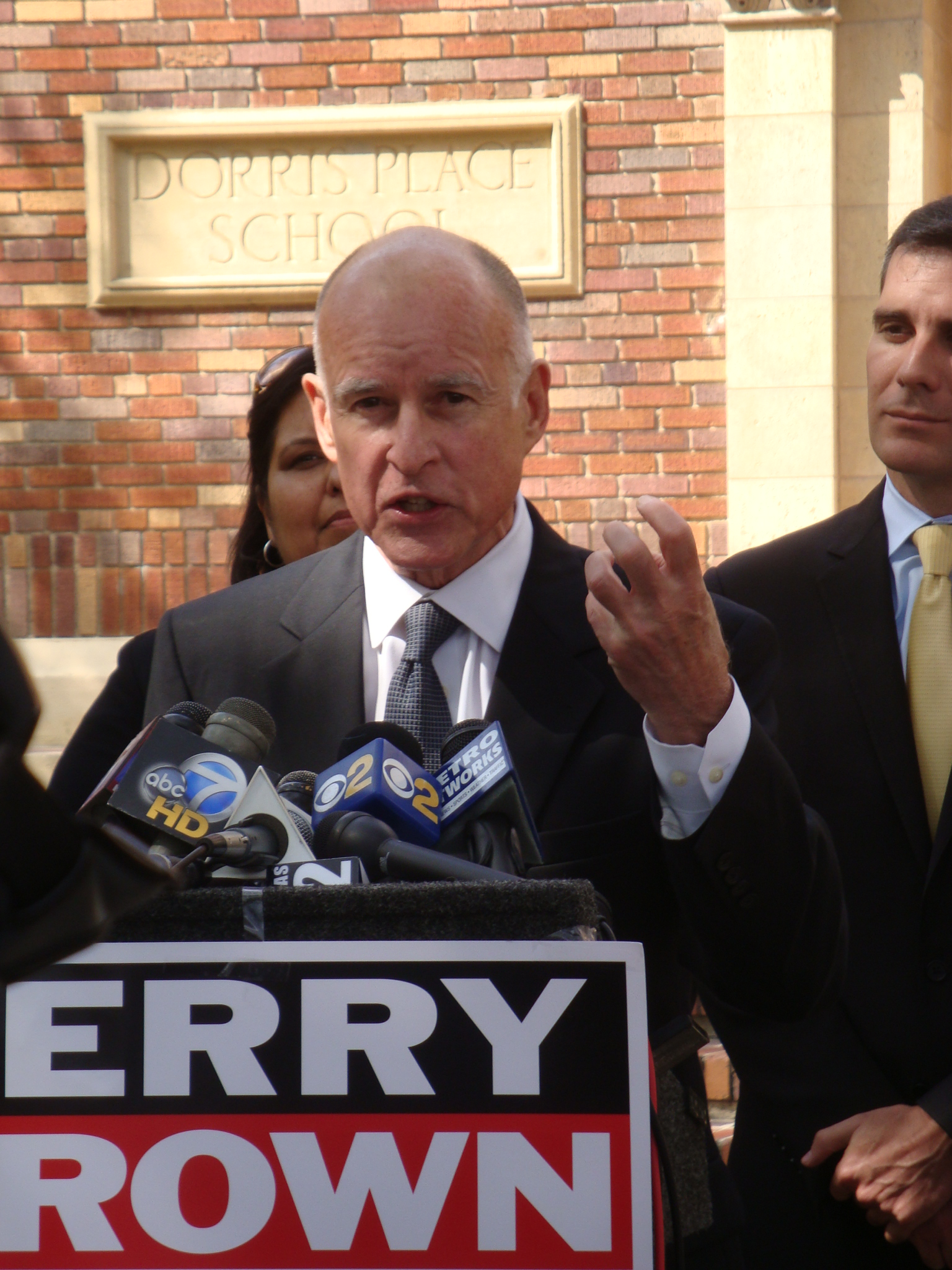

Californians are not too fond of Gov. Jerry Brown so far and they don’t quite understand the state’s budget mess, but they seem to like the ideas that Brown has put on the table for solving the state’s fiscal predicament, according to a new poll from the Public Policy Institute of California.

The survey of 2004 adults found that voters want to protect the schools from budget cuts and like the idea of shifting state programs, and money, to local government. These are two of the pillars of Brown’s budget proposal.

Interestingly, the poll found that Brown’s public approval rating is below 50 percent, his honeymoon apparently cut short by the severity of the state’s problems and the divergent views of a sharply divided electorate. Among all adults, just 41 percent said they approved of his performance so far, while 19 percent disapprove and 39 percent said they were unsure. Brown did better among likely voters, with 47 percent approving of his performance. Fifty-nine percent of Democrats, 27 percent of Republicans and 44 percent of independents approve of Brown’s performance.

Voters’ general reaction to his budget was similarly tepid. But when asked about some of the specific proposals, Californians turned more positive. And the first reaction to his plan to take the issue to a special election in June was also positive.

Overall, 53 percent of voters said they liked his proposal for a mix of cuts and an extension of temporary taxes due to expire this year, while 41 percent were opposed. Among Democrats, 65 percent approved, while 37 percent of Republicans and 60 percent of independents like the idea.

More than 7 in 10 voters, for example, said they liked the idea of shifting state programs to the local level.

Nearly two-thirds of voters said they supported his proposal to phase out redevelopment agencies, which buy and sell blighted land to turn it into housing and businesses, but also siphon off property tax that would otherwise go to schools and local government. Brown wants to use some of that tax money to help balance the state budget and then start giving it to schools and local government.

The best news in the poll for Democrats was the enthusiasm shown for higher taxes. Seventy-one percent said they would be willing to pay higher taxes to protect K-12 education from cuts, 59 percent said they would do so for higher education, and 57 percent for health and human services programs. Only 17 percent said they would favor higher taxes to maintain current spending on prisons.

But when it comes to individual tax increases, voters are less favorable. While 60 percent favor raising taxes on corporations, 38 percent favor raising the personal income tax, 33 percent support increasing the vehicle license fee and 29 percent support raising the sales tax.

One bad omen for the special election, however: 53 percent say they pay more in taxes already than they should. About 40 percent say their tax burden is about right, and 5 percent say they should be paying more.

A large majority — more than 70 percent — also said they would support conservative reform measures to keep the budget in check, including a strict spending limit and a larger rainy day fund.

But this poll, like others before it, also found that voters generally have little understanding of how the state budget works, who pays in and which programs get the most money.

Asked to name the biggest program in state government, only 16 percent could correctly identify Kindergarten-through 12th grade education. Forty-five percent wrongly believed it was the prisons and corrections. And while 29 percent correctly named the personal income tax as the biggest source of revenue, the same number incorrectly said it was the sales tax, 20 percent said it was the motor vehicle license fee, or car tax, and 16 percent said taxes on corporations.

Only 6 percent of voters could correctly name both the biggest source of revenue and the largest spending item in the budget.

To see the entire poll, click here.